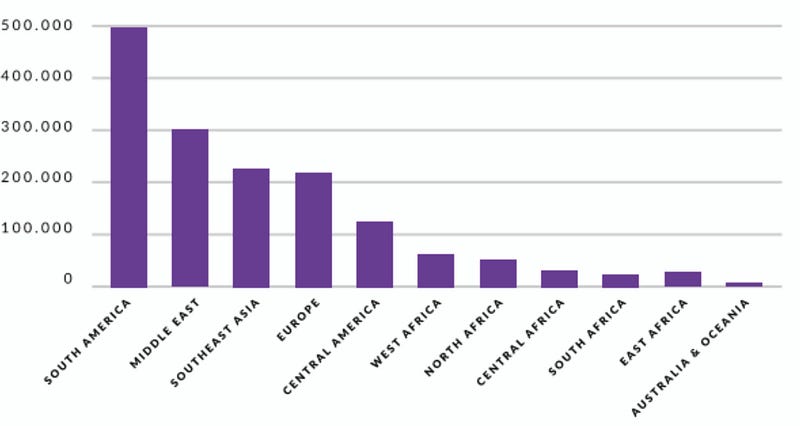

Market challenges and opportunities

Global credit slots

In accordance with World Bank reviews, approximately 70% of all micro, small and medium enterprises in emerging markets have no access to credit. At the same time, the small and medium business stratum is the most promising target audience for the financiers.

SMEs growth globally is capped by inflexible local financing, creating $ 2 trillion credit gap worldwide as accounted by IFC, the World Bank organization:

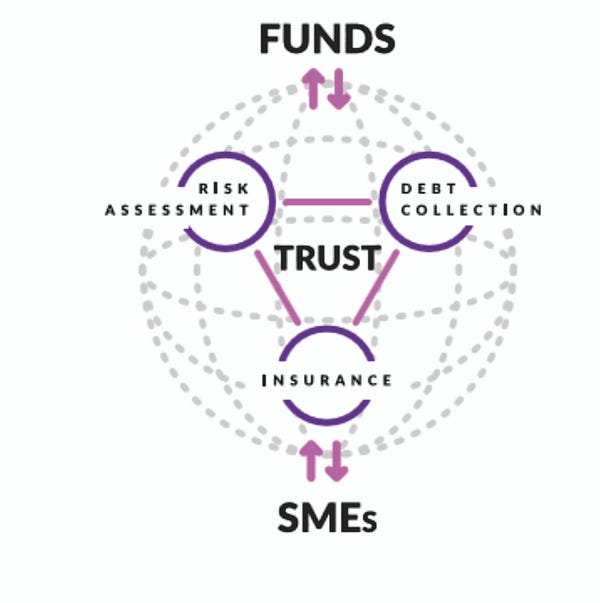

Solution - Network Debitum

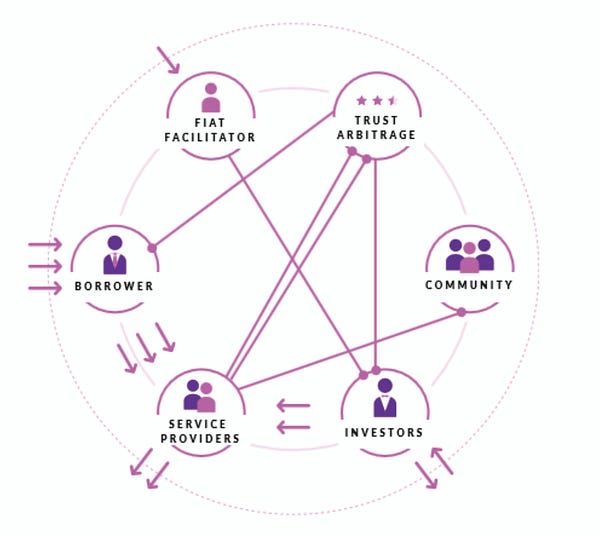

Lending money is all about trust and mechanical gears like collateral, measurable reputation, and fear of punishment. However, in order to overcome the global credit disparity, most of us must operate in young countries where business confidence is not granted. By using a trust-based blockchain solution the Network Debitum ensures the trust required for all partners, especially investors, to operate within the ecosystem

As the Network Debitum operates on a three-sided market. The problem of reaching critical users on all sides (borrowers, investors and service providers) is very important.

TRUST-based

Investors will clearly see the level of trust of potential borrowers and will be able to make a decision of vs. confidence. interest rates.

Anyone will clearly see the level of trust of other counterparty offering services and will be able to create vs. confidence. price decision service.

Communities to see how their members behave individually, leaving organizational decisions based on acquired beliefs or losing the ability to have goal-based information and trust to decide the distribution of available capital to finance SMEs and loans are opportunities that currently do not exist for investors Therefore, the Debitum Network creates a new market, a new asset class that will meet global investor demand, attract their available capital and solve the worldwide credit gap challenge for SMEs.

Infrastructure

Debitum Network is a comprehensive middleware with its core running in Ethereal blockchain and a number of gateways ready to incorporate counterparty running other standard distributed applications.

For security purposes, system infrastructure will be public, easily available to everyone, and private, controlled by system administrators, subnets. The adapter will communicate with the ecosystem through load balancers in the public subnet

41https: //debitum.network

The ultimate goal is to send data to ecosystems on a private subnet. On a personal subnet, EVM for communication with blockchains, will be used. Also, kubernetes cluster where the application, which will communicate with blockchain, and provide data changes intelligent contract status. All infrastructure that is not supported by Ethereal) will run on the Amazon Web Service infrastructure.

Blockchain proves the existence of content, both related to the borrower and associated with the transaction. A hashed note is used for the current time stamp and transaction status. The main textile system stores metadata to complement versions of documents stored elsewhere, in other special blockchain-based systems. Some fair automation will be applied, provided that it does not compel the contributor to change the normal way of law. If the etereum ecosystem gets legitimate acceptance, we will enter the appropriate update. Maximum indexing and labeling of data for future data use and machine learning will be applied.

Debit Token (DEB)

Under a more detailed stream of Debitum tokens is depicted among the various members of the Debitum Network. However, the time between inrush and outflow is an important factor that directly affects the token scarcity and the value of the increase as demand shifts up.

Based on the experience of most investors, especially the largest investors or institutions, are eager to survive in the ecosystem in the long run. Service providers see profitable business opportunities will also stay in the ecosystem for the long term. Borrowers are doubling: SMEs will survive in the short and medium term as they are expected to grow stronger and become 'bankable' and move on to cheaper financing options; while the organizational borrower (operator) must remain in the long run. Thus, we believe that as the Debitum Network grows, more and more members will join that need to use the Debitum token simultaneously, so we should see the demand increase at some point - increasing the token value.

TEAM

ADVISOR

WEBSITE: https://debitum.network/

WHITEPAPER: https://debitum.network/whitepaper

TELEGRAM: https://t.me/joinchat/G6KFmURKsu0FIfJetJ3mOA

TWITTER: https://twitter.com/DebitumNetwork

FACEBOOK: https://facebook.com/DebitumNetwork

Author: Feri577

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=907445

My ETH: 0x3b5277640ae1e5d8f16266674b076ad22eed4f3a

Komentar

Posting Komentar