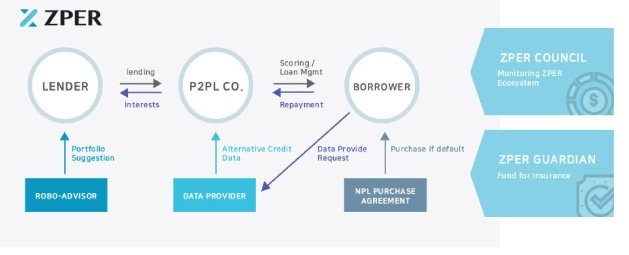

ZPER is a decentralized credit and investment platform based on blockchain technology. It aims to create an innovative P2P finance ecosystem by combining the industrial values and assets of P2P finance all over the world. The ZPER platform will set up a P2P (eXtensible) finance ecosystem that transcends the country and currency brings innovation in global funding. In a ZPER ecosystem, each country's ZPER Councils, data providers, P2P finance companies recognized by Robo Advisors and NPL buyers can come together freely, share their values based on trust and receive fair rewards. Borrowers can get a loan with a lower interest rate while investors have higher yield ratios.

Also, until the end of 2019, there are more than 10 countries, thousands of data providers, and about 30 Robo Advisor companies. we will create an allied ecosystem of 500 well-known P2P finance companies. Such an initiative will provide global funding. will make the investment industry more productive and innovative as a whole and ZER will provide a stable environment in which more than 300 million individuals, more than two million independent enterprises and more than 300,000 SMEs can collect or invest money.

Challenges in P2P Platforms

- Challenges in P2PFinans Company Selection

- Difficulties in Allocating Secure and Efficient Portfolios

- Challenges to Liquidation of Investment Products

- Difficulties in Using Innovative Loan-Valued Data

ZPER's Solutions for P2P Finance Platform

Designing Various Investment Products with the Global P2P Finance Alliance Z2 is an open ecosystem that P2P finance companies and related service companies around the world can join. Trusted P2P financial companies around the world offer a number of P2P investment products here. In addition, RoboAdvisor companies participate in the ZERO ecosystem design, offering safe, global and diversified investment portfolios to minimize the potential investment risks posed by changes in the internal and external financial environment. It also provides a safer investment, such as bond disposals and NPL procurement arrangements.

What is Zper Ecosystem?

P2P Financing Companies Responsible for the overall control of processes related to processes such as borrowers' appraisal, credit generation and reimbursement management. The management of credit contracts and credits should be deeply connected and conducted with the geographical and cultural characteristics of the countries. strictly in accordance with the laws of each country. For this reason, P2P finance companies with credit expertise in each country provide their participation.

How does RoboAdvisor Companies Work?

Investment returns include investment, investment periods, default rates, bankruptcy rates, etc. Based on their own ratios, they are analyzing the investment products in their ecosystem with their own algorithms and structuring them to enable investors to diversify their investments. to make more profit. Investors can choose from a range of portfolios designed by more than one RoboAdvisor company.

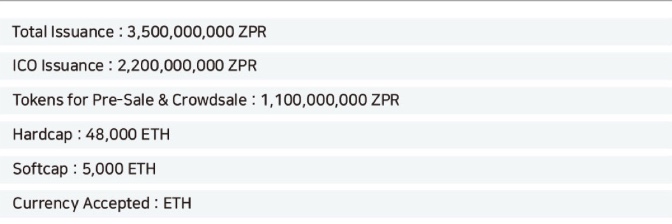

Token Sale

ROADMAP

Website: https://zper.io/

Twitter: https://twitter.com/zper_team

Whitepaper: https://zper.io/paper/Whitepaper_Eng.pdf

Facebook: https://www.facebook.com/ZPERplatform/

Medium: https://medium.com/@zper

Telegram: https://t.me/zper_kr_official

Youtube: https://www.youtube.com/channel/UCGhrxEcpchjMSg7EclXuGFw

Author: Feri577

Bitcointalk: https://bitcointalk.org/index.php?action=profile;u=907445

My ETH: 0x3b5277640ae1e5d8f16266674b076ad22eed4f3a

Komentar

Posting Komentar